Wall Street saw dramatic losses after former President donaldtrump announced sweeping new tariffs on imports from 66 countries. The news, spreading rapidly across breaking news networks, sent shockwaves through the us) economy and fueled fears of renewed recession.

Major indices like the S&P 500 and Nasdaq posted their worst daily declines this year, reflecting investor anxiety over higher costs, trade retaliation, and supply chain chaos.

Numbers Tell the Story

S&P 500 fell over 3.2%

Nasdaq dropped nearly 4.1%

The Dow Jones saw intraday losses of almost 1,100 points

Analysts blamed sudden uncertainty about consumer prices, global growth, and corporate profits.

Why Markets Reacted So Sharply

Trump’s tariffs target billions in imported goods, including technology, auto parts, and raw materials.

Market experts say:

Costlier imports will squeeze margins for manufacturers

Higher consumer prices could curb spending

Export-driven sectors risk retaliation abroad

In short: rising costs, weaker demand, and global instability.

Investors Fear a Domino Effect

The sell-off wasn’t limited to American stocks. European and Asian markets echoed the decline as traders priced in:

Possible counter-tariffs from the EU and Asia

Supply chain bottlenecks affecting big tech and auto firms

Slower global GDP growth in late 2025

Gold prices jumped as investors sought safety.

The Federal Reserve Angle

The new tariffs complicate the federalreserve)’s delicate balancing act:

Inflation could climb if import costs surge

Growth could slow if consumer spending weakens

Chair jeromepowell now faces fresh pressure to adjust interest rate policy.

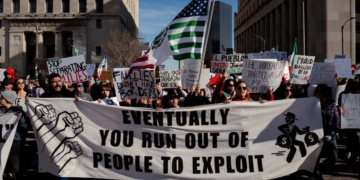

Political Shockwaves Too

Critics say the tariffs amount to an election-year gamble to rally Trump’s base.

Business groups warn:

Jobs tied to global trade are at risk

Small businesses importing parts could see sudden cost spikes

Supporters argue tariffs are overdue to fix chronic trade deficits.

Wall Street Reacts

Big losers included:

Tech giants dependent on Asian supply chains

Automakers facing higher steel and parts costs

Retailers stocking imported goods

A few domestic producers—like steel and aluminum firms—saw modest gains.

Beyond the Numbers: A Test of Confidence

Market volatility shows how deeply global investors watch U.S. policy. When decisions appear sudden or politically motivated, uncertainty spikes.

For now, traders brace for more swings as August 7 approaches.

What Happens Next?

Foreign governments may rush to negotiate partial exemptions

The White House could tweak tariffs if markets drop further

Investors await corporate earnings to see how badly costs rise

The true impact may only appear in late 2025 reports.

Final Thought

Tariffs aren’t just numbers—they’re signals.

This latest move by trump) is reshaping not only trade routes but market psychology.

The fear now? What if this is only the start.