As summer unfolds, millions of Americans are watching economic headlines with growing concern. Recent volatility in the stock market, stubborn inflation, and looming debates over federal spending have combined to create a sense of uncertainty. Reports from major outlets like Fox News, CNN, Reuters, and Bloomberg reveal a nation caught between recovery and recession fears — and voters are feeling it.

Signs of Trouble in the Economy

The latest figures from the Federal Reserve show modest GDP growth but continued inflationary pressure, particularly on essentials like food and housing. According to analysts, energy prices have stabilized since last year’s spikes, yet everyday costs remain high, squeezing household budgets.

Economists warn that while the job market remains historically strong, rising interest rates aimed at cooling inflation could eventually slow hiring and growth.

Market Volatility Shakes Confidence

The stock market has swung sharply in recent weeks. Financial news outlets including Bloomberg and Fox attribute this to investor uncertainty over Federal Reserve policy, mixed corporate earnings, and geopolitical tensions.

For everyday Americans with retirement savings and 401(k) plans, these market swings translate into real anxiety about long-term financial security.

The Political Backdrop

Adding to the uncertainty is deepening political gridlock in Washington. Negotiations over the federal budget and debt ceiling have sparked partisan battles. Lawmakers are divided over tax policy, social spending, and defense funding.

Donald Trump and other Republican figures criticize what they call “reckless spending,” while Democrats argue more investment is needed to support working families.

Inflation and the Cost of Living

According to Fox News and CNN reports, American families continue to cite inflation as their top economic worry. Grocery prices remain elevated, and rents in major cities like New York, Los Angeles, and Washington, D.C. have hit record highs.

Even modest wage growth hasn’t fully kept pace with rising costs, making the recovery feel uneven.

How the White House Is Responding

The White House has highlighted falling gas prices and continued job growth as signs the economy remains resilient. President Biden’s team argues that long-term investments in infrastructure and clean energy will help lower costs over time.

Critics, however, point out that core inflation remains above the Federal Reserve’s target, fueling concern among businesses and consumers alike.

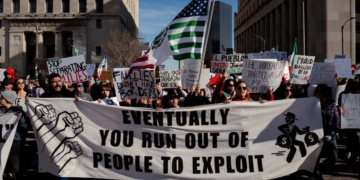

Voices from Main Street

Interviews from Reuters and local news stations reveal how economic anxiety is felt across the country. Small business owners worry about borrowing costs, parents stretch paychecks to cover childcare and groceries, and recent college graduates face a competitive housing market.

Despite the challenges, consumer spending has stayed relatively strong — at least for now.

The Role of the Federal Reserve

Jerome Powell, chair of the Federal Reserve, has signaled more interest rate hikes may be necessary if inflation doesn’t slow. Financial analysts debate whether this could trigger a mild recession or achieve a “soft landing.”

Either way, Powell’s comments move markets and shape economic expectations for the months ahead.

Political Fallout

The economic debate is already reshaping the 2024 presidential race. Candidates including Donald Trump and Ron DeSantis blame the current administration for high inflation, while Democrats argue global factors and pandemic recovery explain much of the pressure.

In Congress, new proposals range from tax cuts to expanded child credits, reflecting different visions for how to help American families.

The Bigger Picture

Economic stress intersects with other national issues: healthcare costs, housing shortages, and climate policy debates. As Fox News, CNN, and Politico note, voters rarely separate pocketbook issues from broader questions about leadership and priorities.

This complexity makes predicting political consequences tricky — and underscores why economic messaging is so central to every campaign.

Experts Urge Perspective

Some economists urge Americans not to panic, pointing to record-low unemployment and rising wages. Yet they caution that sustained inflation could erode gains if policymakers and businesses don’t adapt.

Historical patterns suggest economies often adjust after periods of overheating, but the process can be painful.

Outlook for the Rest of the Year

Most forecasts suggest modest growth ahead, with inflation gradually easing. Yet new shocks — from geopolitical conflicts to supply chain disruptions — could change the picture quickly.

Business leaders, including those at Fortune 500 firms, continue to plan cautiously, balancing hiring and investment against market risks.

What Americans Can Do

Financial advisors recommend classic steps: build emergency savings, avoid high-interest debt, and review budgets to account for rising costs.

While individuals can’t control macroeconomic trends, small adjustments can protect family finances during volatile periods.

Conclusion

America’s economic story in 2025 is one of resilience mixed with real worry. The fundamentals remain strong, yet inflation, market volatility, and political fights leave many families uncertain.

As policymakers debate solutions and the media covers each twist, millions hope for calmer months ahead — but prepare for more turbulence.