As is his custom of stirring controversy, US President Donald Trump adopted an ambitious, comprehensive tax bill dubbed the “Big Beautiful Bill.” Through this bill, Trump sought to restructure government spending in the United States and restructure the country’s tax system to align with his vision of protecting the border, increasing military spending, and achieving his economic and political priorities. Join us as we explore the most important aspects of this bill.

The general framework of Trump’s tax bill, which totals $3.3 trillion, includes:

- $4.5 trillion in tax cuts over ten years

- $1.2 trillion in spending cuts, primarily targeting social welfare programs.

Key objectives:

- Extending the tax cuts, he enacted during his first term in 2017.

- More targeted tax relief for specific groups.

- Funding border security operations and deporting illegal immigrants.

- Cutting spending on social welfare programs and poverty support.

- Increasing military funding and support.

Timeline for passage:

- The Senate passed the tax bill on July 1, 2025, by a narrow vote of 51 to 50, with Vice President J.D. Vance’s deciding vote.

- The House of Representatives passed the bill on July 3, 2025, by a vote of 218 to 214.

- President Donald Trump is expected to sign the bill into law on July 4, 2025.

Tax Details

The new tax law allows for the extension of the 2017 tax cuts:

- The bill makes permanent the tax cuts included in the Tax Cuts and Jobs Act of 2017, which were scheduled to expire at the end of 2025. These cuts include:

- A reduction in individual and corporate income taxes, increasing the standard deduction by $1,000 for individuals, $1,500 for heads of households, and $2,000 for married couples (through 2028 only).

New tax breaks:

- Abolishing taxes on tips, targeting service sector workers such as restaurants.

- Abolishing taxes on overtime pay to support middle-income workers.

- Abolishing taxes on Social Security income to ease the burden on seniors.

- Auto loan exemptions to encourage consumption.

A child tax credit:

- Providing a $1,000 federal contribution to tax-free “Trump Baby Accounts” for children born during the Trump presidency.

- Increasing the child tax credit from $2,000 to $2,200, adjusted annually for inflation.

Corporate tax cuts:

- Making temporary tax breaks permanent, including depreciation, amortization, and research and development deductions.

- Raising the chip industry investment tax credit from 25% to 35%.

SALT tax reforms:

Increasing the maximum state and municipal SALT exemption to $40,000 for married couples earning up to $500,000, through 2030. The previous limit was $10,000 under the 2017 law.

Border Security and Deportation Funding for Illegal Immigrants:

- $45 billion allocated for Immigration and Customs Enforcement (ICE) detention centers.

- $14 billion for deportations.

- More than $50 billion for border fortifications, including the completion of the wall on the Mexican border.

- This funding will allow for the hiring of 10,000 new employees by 2029 to support immigration policies.

Goal: Implement Donald Trump’s plan to deport undocumented immigrants, a top priority

Spending Cuts

Include cutting spending on some social welfare and environmental programs, most notably:

Social Welfare Programs:

- Funding for the Medicaid program for low-income Americans and those with disabilities will be cut by nearly $1 trillion over a decade, potentially resulting in 11.8 million people losing their health coverage by 2034.

- Stricter enrollment standards and reduced federal payments to states.

- SNAP (Sanitation and Food Assistance Program): Spending for the program, which supports more than 40 million Americans, will be cut, impacting low-income groups most.

Clean Energy:

- Repeal the $7,500 tax credit for electric vehicle purchases by September 30, 2025, which has angered Elon Musk due to its impact on Tesla.

- End tax incentives for solar and wind energy projects after 2027, while abandoning a proposed tax on projects that use Chinese components.

Cut Government Spending:

Focus on reducing “waste and fraud” in government programs, according to Republican statements.

Economic and Social Impacts of the New Tax Bill

Tax Distribution:

More than 80% of Americans are expected to benefit from the tax cuts in 2026, according to the nonpartisan Tax Policy Center, but the wealthy will receive even larger benefits as a percentage of their income.

The Yale University Budget Lab estimates that taxpayers in the bottom quintile of incomes will see their incomes decrease by 2.5% due to the Medicaid and SNAP cuts, while those with the highest incomes will see an increase of 2.4%.

National Debt:

The bill is expected to add between $3.3 and $3.4 trillion to the national debt by 2034, increasing the national debt from $36.2 trillion and possibly more.

Raising the debt ceiling by $5 trillion using a “budget reconciliation” mechanism to bypass Democratic opposition.

Impact on Industry:

Clean Energy: Eliminating incentives hurts companies like Tesla and impacts renewable energy projects.

Microchips: Increased tax breaks support the semiconductor industry.

Social impact:

Human Rights Watch warned that the law deepens the gap between rich and poor and threatens basic human rights.

An estimated 12 million Americans will lose their health insurance by 2034 due to Medicaid cuts.

Tax bill implications

The tax law has sparked widespread controversy, with both supporters and opponents. The following are the most prominent reasons for support and criticism:

Republican support:

Republicans view the bill as a historic achievement that advances the “America First” agenda and supports economic growth.

Republican Rep. Virginia Foxx described the bill as providing “historic tax relief for working families” and an investment in border security.

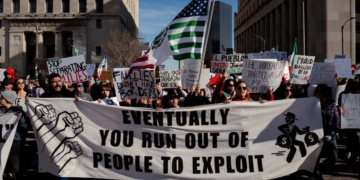

Democratic opposition:

Democrats described the bill as a “gift to the rich” at the expense of the poor, focusing on its impact on health care and food programs.

Democratic Minority Leader Hakeem Jeffries delivered a record-breaking eight-hour speech against the bill, calling it a “reckless Republican tax gimmick.”

Senator Mark Warner described these cuts as “tax cuts for the wealthy leading to healthcare cuts.”

Elon Musk’s criticism:

Musk described the project as “horrible” and a “disgusting, shameful act,” warning of an increase in the fiscal deficit to $2.5-$5 trillion and a negative impact on future industries like electric cars.

Elon Musk threatened to campaign against lawmakers who voted for the project, citing its impact on Tesla.

Economic warnings:

Federal Reserve Chairman Jerome Powell warned that the US fiscal path is “unsustainable.”

The International Monetary Fund noted that the project contradicts its recommendations for reducing the fiscal deficit.

Economists such as Ken Rogoff have described Trump’s tariff policies as a “nuclear bomb on the global trading system.”