From Cash to Crypto: How Digital Payments Are Taking Over America

swiping cards to tapping phones — and now scanning wallets on blockchain networks — the evolution of digital payments is reshaping the American economy and consumer behavior.

The question is no longer if cash will disappear, but when.

Goodbye, Cash: The Rapid Decline of Physical Money

Cash use in the usa has been steadily declining. According to Federal Reserve surveys, fewer than 20% of consumer transactions in 2025 involve physical bills. Major retailers now operate “card-only” stores, while urban areas have entire blocks that are cash-free.

Why the shift?

-

Speed and convenience

-

Security (no theft risk)

-

Easier tracking of expenses

-

Integration with e-commerce and apps

This transition accelerated during the pandemic when digital payments became a health precaution as well as a convenience.

Rise of Crypto in Everyday Life

Once seen as a fringe movement, cryptocurrency is now a practical tool for millions of Americans.

Bitcoin, Ethereum, and stablecoins like USDC are being used for:

-

Online shopping

-

Investment portfolios

-

Cross-border payments

-

Peer-to-peer transfers

-

Business-to-business invoicing

Major companies like Tesla, PayPal, and Shopify now accept crypto. Even donaldtrump made headlines recently for launching his own digital token campaign donation platform — signaling how deep crypto is entering mainstream American life.

The Role of the Federal Reserve and Central Bank Digital Currency (CBDC)

The federalreserve is not standing still. It has been actively exploring the launch of a U.S. Central Bank Digital Currency (CBDC) — a government-backed digital dollar that would function like cash but exist only in digital wallets.

Potential benefits include:

-

Faster federal aid and stimulus distribution

-

Improved tracking of economic trends

-

Reduced fraud in payment systems

-

Modernized tax collection

However, critics (especially voices on foxnews and trumpnews) warn that a CBDC could lead to government overreach — giving Washington the power to freeze or monitor personal spending with little accountability.

Privacy Concerns and Surveillance

Unlike cash, every digital transaction leaves a trail. This raises serious concerns about:

-

Data harvesting by banks and tech companies

-

Real-time tracking of purchases

-

Loss of anonymity in political donations

-

Potential censorship of transactions

Conservatives and civil liberties advocates argue that digital payments open the door to Orwellian-style financial control, especially if tied to whitehouse political agendas or private sector partnerships.

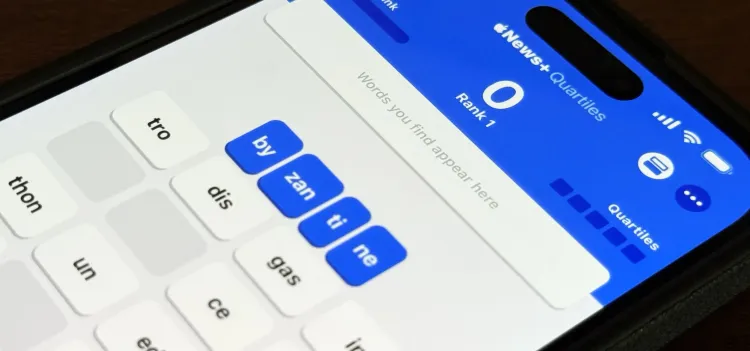

Mobile Payment Apps: The New Wallet

Apps like Venmo, Cash App, Zelle, and Apple Pay are dominating U.S. transactions, especially among Gen Z and millennials. These platforms have effectively replaced wallets, checks, and even traditional banking for millions.

Advantages include:

-

Instant transfers

-

Social integration (e.g., Venmo feeds)

-

Budgeting tools

-

Crypto integration in some apps

But they’re not risk-free. Hacks, fraud, and data breaches have increased dramatically. Despite that, trust in these platforms continues to rise — largely because of convenience.

E-Commerce and Contactless Retail

Amazon, Walmart, and Target have reshaped American retail to prioritize contactless payments and frictionless checkouts.

-

NFC-enabled terminals

-

QR code scanning

-

Voice-activated purchases via smart assistants

Combined with crypto wallets and digital gift cards, the payment experience has become faster than ever — but also more integrated with customer data collection systems.

Is Cash Becoming a Liability?

More businesses now view cash as a cost, not an asset. Handling, counting, transporting, and securing cash eats into margins. That’s why small cafés, food trucks, and even vending machines have gone digital.

Ironically, cash is now more common among:

-

Older Americans

-

Unbanked populations

-

Conspiracy theorists fearing government surveillance

This demographic gap is pushing policymakers to ensure that the digital revolution is inclusive.

Crypto Regulation: America at a Crossroads

With the growth of crypto payments, Washington and columbia university analysts are debating:

-

How to classify crypto: commodity, currency, or security?

-

How to tax peer-to-peer transfers and NFTs

-

Whether to allow anonymous wallets

-

How to prevent terrorism financing through crypto

Bipartisan bills are being pushed through Congress, and voices like greggutfeld are calling for a balance between freedom and oversight.

Public Awareness Is Key

Despite the surge in usage, many Americans still don’t fully understand:

-

What stablecoins are

-

How blockchain works

-

The risks of decentralized finance (DeFi)

-

How to protect digital wallets

This lack of financial literacy could make millions vulnerable to scams, fake crypto exchanges, or predatory platforms.

The Road Ahead: What It Means for Americans

The rise of digital payments means:

-

More control — but also more exposure

-

Faster transactions — but fewer privacy rights

-

Economic modernization — but potential exclusion for the unbanked

Americans must adapt quickly or risk being left behind. Education, regulation, and innovation must move together — or the promise of financial freedom could turn into digital dependence.