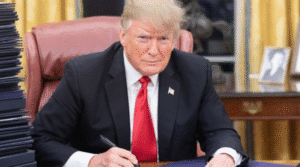

Trade Tariff War: Trump’s War on Exports and the Rebuke of Allies

Economic warfare can be more deadly and destructive to enemies than any military confrontation. Imagine having the power to make a single decision that could shake global markets, disrupt supply chains around the world, and put key industries at a crossroads, causing price increases and turmoil in global stock markets. President Donald Trump has wielded this immense power and did not hesitate to use it when he imposed the new tariffs.

Trump justified these decisions by seeking to rebalance the United States’ trade balance, particularly with its main adversary, China. To achieve this goal, Trump ignored key U.S. allies in the European Union and Canada, as well as the trade agreements concluded by previous presidents. He believed everyone would eventually give in and sought to forge new agreements through which he could maximize his gains.

Let’s shed light on Trump’s tariffs, analyze their impact on the U.S. economy, and see whether they achieved their intended goals.

Trump’s Tariffs:

The administration of former US President Donald Trump imposed broad tariffs on imports from around the world, justifying this by seeking to rebalance the US trade balance and promote domestic industry.

Tariffs and their Implementation:

Trump announced a 10% base tariff on all goods imported into the United States, with the potential to increase these tariffs to between 15% and 50%, and possibly as high as 125% on China, his main competitor.

He also imposed a separate 25% tariff on foreign-made cars.

Stated Goals:

· Reducing the US trade deficit.

· Improving the competitiveness of US manufacturers.

· Encouraging US consumers to purchase domestically produced goods.

· Addressing trade practices he considers unfair, such as government subsidies and currency devaluation.

Targeted Countries:

The tariffs targeted numerous countries, including China, the European Union, Canada, and Mexico, as well as several Arab countries to varying degrees, including Qatar, the United Arab Emirates, Saudi Arabia, Egypt, Kuwait, Sudan, Yemen, Lebanon, Djibouti, Oman, Bahrain, Morocco, Syria, Iraq, Libya, Algeria, Tunisia, and Jordan.

Country Reactions:

Country reactions to Trump’s tariffs ranged from rejection, to attempts at negotiation, to even countermeasures:

· China described the US tariffs as “unilateral bullying” and “unjustified,” asserting that “there are no winners in trade wars.” It threatened to take countermeasures and file complaints with the World Trade Organization.

· Canada: Canada responded by imposing 25% tariffs on $155 billion worth of US imports, considering it a tit-for-tat measure.

· The European Union was preparing to implement a potential retaliatory package on US goods worth more than $100 billion.

· Brazil: Announced it will retaliate against US tariffs in accordance with the Reciprocity Act.

· Other countries: Some countries, such as Australia, have announced they will not retaliate, while others have called for negotiations.

Impacts of Tariffs on the global economy:

Trump’s tariffs have had significant impacts on the global economy, including:

· Disruption of markets and supply chains: These decisions have disrupted trade flows in global markets and potentially slowed them.

· Impact on global trade: These measures have been described as the largest change in global trade norms since World War II.

· Risks of a global recession: Economists believe that Trump’s new tariff plan could push the global economy toward worse performance, increase uncertainty, and possibly lead to a global recession, especially if it continues and other countries take harsh retaliatory measures.

· Stock market declines: Global and regional stock markets, including those in the Gulf and Egypt, have experienced sharp declines due to concerns about tariffs.

· Implications for Middle Eastern countries: The economies of Gulf and Middle Eastern countries have been affected by these tariffs, and these policies could lead to the formation of new economic blocs.

· Inflation: There are concerns about the impact of these tariffs on inflation and the increase in annual costs for consumers.

The Impact of Trump’s Tariffs on American Citizens:

Trump’s tariffs have had direct and indirect impacts on American citizens, most notably:

Rising Prices and Increased Inflation:

Direct Cost to Consumers: Tariffs are taxes imposed on imported goods. Importing companies pay these taxes, but they are often passed on to consumers in the form of higher prices. As a result, the prices of many imported products on which American consumers rely have risen.

Impact on Commodities: Numerous studies have warned that tariffs could raise the prices of basic commodities such as fruits, vegetables, and meat, as well as cars, clothing, and crude oil, which constitute a significant portion of household budgets.

Estimates of the Cost to Households: Some analyses, such as those from the Yale University Budget Lab, have estimated that Trump’s tariffs could cost American households thousands of dollars annually due to higher prices. Some estimates have indicated a cost of up to $2,300 or even $4,900 per household per year, depending on the circumstances and the goods affected.

Inflation: Tariffs have contributed to increased inflationary pressures, reducing the purchasing power of the US dollar.

Reduced Product Choice:

Reduced Inventory and Diversity: Due to uncertainty about tariff levels and potential costs, some retailers and suppliers have reduced the variety of products they import, fearing higher tariff costs or the loss of expensive imported goods. This has impacted the availability of some goods and consumers’ choices, especially during shopping seasons such as the holidays.

Delayed Product Arrivals: Fluctuations in tariff policies have led to delays in production and shipping schedules, resulting in delayed arrivals of products to US warehouses.

Different Effects Among Households:

Low-Income Households: Low-income households are often more affected by tariffs because they spend a higher percentage of their income on tariff-related imported goods, such as food, clothing, and energy, compared to higher-income households who spend more on services.

Market Uncertainty:

Impact on Investment: Volatile and unstable trade policies have created uncertainty among businesses and investors, impacting investment and expansion decisions, which in turn could impact job opportunities and long-term economic growth.

Note:

In short, while Trump’s stated goal was to protect American industry and reduce the trade deficit, the direct consequences for American citizens have been higher living costs and reduced shopping options, particularly impacting household budgets.

Also read:

l should-you-buy-bitcoin-now-or-is-it-too-late-in-2025

l the-chip-wars-and-their-effect-on-the-consumer-who-controls-the-future-of-technology

l a-leak-reveals-the-iphone-17s-battery-capacity-predicting-radical-changes

l samsung-unveils-its-thinnest-phone-the-galaxy-z-fold-7

l a-self-driving-tesla-taxi-crashes-into-a-parked-vehicle

l a-chinese-humanoid-robot-cooks-using-virtual-reality