Imagine a world where the latest technologies are perpetually out of reach, whether through limited supply, higher tariffs, or other geopolitical maneuverings. This reality is becoming more tangible due to the chip wars. A few days ago, news outlets reported that the U.S. is planning to tighten AI chip exports, impacting countries like Thailand and Malaysia, all in an effort to stop advanced technology from reaching China.

Meanwhile, China recently unveiled “Meteor-1”, the world’s first highly-parallel optical computing chip. Optical computing uses light beams instead of electrical signals, which works faster, generates less heat, and slashes energy consumption, making it perfect for AI computing. While still a young technology, it’s becoming more viable, and threatens to make current electrical chips obsolete.

These aren’t isolated incidents, but rather escalating maneuvers in the saga of microchip wars, where each camp vies for technological dominance through controlling semiconductors; the tiny brains of all modern electronics.

This article delves into these conflicts, and how decisions made in Washington, Beijing, and corporate boardrooms can affect your daily life, influencing what devices you can buy and how much it costs, and the overall future of technology.

Understanding the Battlefield: The Semiconductor Landscape

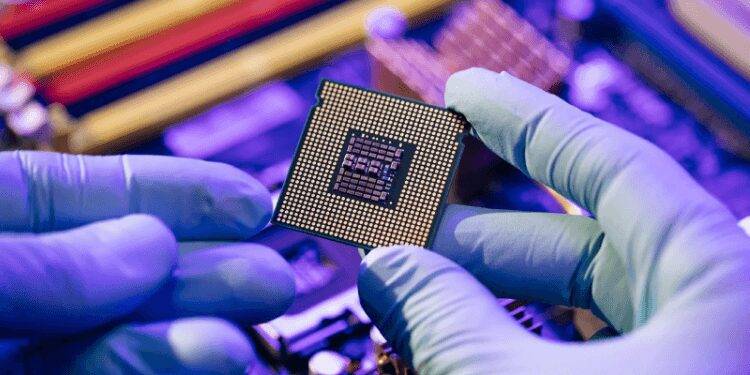

To understand what the chip wars entail, it’s a good idea to understand the technology itself, or what they’re fighting over. Semiconductors are essentially the building blocks of the digital age. They are comparable to neuronal cells, or the “brains” of all electronics, enabling them to do calculations.

What are Semiconductors (Chips)?

If a conductor is a material that conducts electricity reliably, and an insulator is a material that blocks the flow of electrons, then semiconductors are materials (mainly silicon) that can be manipulated to either conduct or block an electrical current.

This property allows them to act as a tiny switch, and process information in a binary code (Ones and Zeroes), where 1 means conduct, and 0 means block. Semiconductors are arranged to form transistors and integrated circuits. They are the building blocks of all modern technology. For example, they can be found in:

- Smartphones, smart watches, computers, laptops, and gaming consoles: where they provide processing power, memory, and connectivity.

- Home appliances: particularly those that have “Internet of things” or “smart” features, but not limited to them. Such as washing machines, refrigerators, microwaves, light bulbs, etc…

- Automobiles: they control everything from power management to driver assistance systems to electric batteries.

- Advanced technologies: Used extensively in AI, cloud computing, data centers, surveillance, space programs, modern warfare and defense systems

Key Players in the Chip Wars:

While silicon itself is incredibly abundant, it is used in tandem with other rare earth elements (especially in higher-end chips). Additionally, the production of microchips is a lengthy and complex process, where different regions excel in specific areas.

Below, you’ll get to know the global players in the chip wars, and what leverage they have.

United States

The united states is still the global leader in chip design and has many recognizable brands (Intel, Qualcomm, Nvidia, AMD, Broadcom), it also controls advanced equipment manufacturing (Applied Materials, Lam Researh, KLA). The U.S. share of the manufacturing capacity declined over the years (about 12%), but they still retain the intellectual property.

Taiwan

Overall, the Taiwan Semiconductor Manufacturing Company (TSMC) produces 60% of all semiconductors, the biggest producer in the world. It holds a near monopoly (90%) on the manufacturing of the most advanced chips. They produce most of the world’s supply of sophisticated logic chips, essential for high-end computing, premium smartphones, and AI. It’s the world leader in sub-5nm process technology.

China

China invests heavily in local semiconductor manufacturers (e.g. SMIC and Hua Hong Semiconductors) in order to reach self-sufficiency. The country controls most of the world’s reserve of rare earth minerals essential for high-end chips like gallium and germanium. However, they still rely on the intellectual property and equipment from foreign countries.

Europe

The European Union is aiming to double its share of global chip production by 2030. Europe is particularly known for automotive chips (infineon, STMicroelectronics, NXP). They focus more on the automotive and industrial sectors.

The Netherlands: While they don’t produce semiconductors directly, the Dutch company ASML is the world’s only supplier of EUV lithography machines, a crucial equipment in producing advanced semiconductors. Their machines rely on a global supply chain, including critical components from the U.S., so they are pressured by them to not export advanced machines to China.

South Korea

a major player with companies like Samsung and SK Hynix, particularly in memory chips (DRAM, NAND flash), and offers advanced foundry services, accounting for 17% of the global market. They also challenge the Taiwanese hegemony on high-end logic chips.

Other Players

Other countries like Japan, Malaysia, India, and Vietnam are also vying for a larger share in the market. Japan specializes in equipment and materials, while Malaysia, India and Vietnam provide services like chip assembly, testing, and packaging (back-end processes).

The Global Supply Chain – A Complex Web:

The creation of even a single microchip today requires a complex, multi-step process and cross-continental coordination. It starts from the mining and purification of raw materials, the design of the microchip, the fabrication, assembly, testing, and finally packaging. It is a global cooperative effort. If any part of this process is disrupted, due to geopolitical tension or unforeseen circumstances, the entire production chain comes to a halt, impacting the quality, price, and availability of the final consumer product. The chip wars threaten this delicate balance.

The Genesis of the “Chip Wars”: Drivers and Causes

The main cause of the chip wars is the rivalry between the United States and China.

For the U.S. the rapid advancement in China’s military capabilities, AI, and 5G represents a threat to its technological hegemony and national security, so they responded with technology sanctions, Tariffs, and export controls to limit China’s access to advanced chip manufacturing technologies, and to force them to rely on U.S. patents. This includes restrictions on companies like Huawei and SMIC.

China also sees its reliance on foreign technology as a geopolitical risk, and aims to develop new technologies (such as the Meteor-1 optical computing chips). This bypasses the need for foreign patents, and encourages technology sovereignty.

Besides funding research, they also use their reserve of rare Earth elements as a bargaining chip, threatening non-compliant countries with export controls. Rare minerals are not a requirement in legacy microchips, but they are essential in high-end chips to improve performance.

Techno-Nationalism and Industrial Policy

Aside from direct confrontation, a wave of economic and political nationalism has swept over the world as of late, spurring many governments to focus on onshoring semiconductor production. This is partly due to the chip shortage that happened during the COVID-19 pandemic.

Governments are offering semiconductor subsidies to onshore manufacturers. For example, The U.S. CHIPS and Science Act (2022), which allocated $52 billion in subsidies and tax credits to semiconductor manufacturing and research within the U.S.

The EU Chips Act aims to mobilize over €80 billion in investments to revitalize chip production in the European continent.

This encourages companies like Intel, TSMC, and Samsung to build fabrication plants (fabs) in Europe and the U.S., because they will get significant tax breaks.

Even if it’s a foreign company, having onshore production plants reduces the supply chain risk and provides training and high-tech jobs to the local population.

How the COVID-19 Pandemic affected supply chains

The geopolitical tension over microchips was simmering for years, but it reached a boil during the pandemic. Factory shutdowns, particularly in Asia, have severely impacted the number of available chips in the market, and exposed the fragility of the current global supply chain.

The lockdowns also increased demand for electronics, as many people shifted to remote work and online schools, boosting demand for computers, webcams, gaming consoles, and networking equipment.

When the pandemic hit, some manufacturers prioritized the high-end chips used in smartphones, data centers, and AI, as these are more profitable. This unintentionally slashed their production of “legacy” or “mature node” chips, which are less profitable but essential for many everyday products like home appliances and vehicles. This weakened the automotive industry the most, leading to production cuts and plant shutdowns.

The pandemic revealed that the semiconductor industry is not just a matter of economic competition, but of national security and resilience. This industry alone has profound implications on the global supply chain, and how goods are produced and consumed worldwide. Technology sovereignty became more important than ever.

Short and Long Term Impacts on Consumers

In the immediate aftermath, this combination of supply chain disruption, chip shortage, and high demand caused a noticeable price inflation, which is passed down to the end consumer.

Price and Availability

The price hike hit smartphones and laptops the most, including both flags-ship models and mid-range devices. Many laptops were also unavailable, particularly those those with built-in advanced GPUs.

GPUs in general were already under heavy demand due to virtual currency mining, affecting the average consumers who only needed them for personal computers.

New gaming consoles like the PlayStation 5 and Xbox Series X were notoriously hard to find at launch, to the point that scalpers were buying whatever limited stock available, just to resell them later for exorbitant prices. Over the years, game developers were less likely to offer console-exclusive games (because most potential buyers didn’t acquire the console fast enough), so this market never recovered.

Home appliances have seen a price creep, especially those with smart features. This is more ubiquitous than in seems, as even devices like high-end toasters incorporate microchips.

Electric vehicles were also under massive demand and they heavily rely on advanced semiconductors for battery management, autonomous features, and infotainment, causing price hikes across the board.

To this day, consumers face difficulty finding newer models, and may get “out of stock” messages or have to wait for long “pre-order” queues whenever there’s a highly-anticipated device. Product launches have also been delayed.

Design and Innovation

In the longer term, companies are forced to design their products around the chip shortage. For example, offering less models, or with less features, or having to design a product that optimizes the less advanced chips. This makes it harder for them to focus on innovation, instead they will have to meet the current market needs. It’s going to slow down technological innovation.

Even if new advancements are made, producing a steady supply for the end consumer is a different story, which means they will have to wait much longer for real technological advancements.

Consumers may be forced to buy older models or less preferred features or brands, because their preferred product is either priced out of reach, or simply unavailable. The manufacturer may also have to use less optimal chips which could affect device performance and reliability.

Indirect and Long Term Impact

While the direct impact of pricing and availability are immediately felt, the chip wars are also setting up more systemic change that is yet to be seen in the years to come.

Technological fragmentation

For starters, techno-nationalism can lead to the development of increasingly separate tech ecosystems and standards. If China, Europe, and the U.S. all develop separate semiconductor supply chains, they may also develop different software or hardware architecture that are incompatible with each other.

To understand this, think about how IOS and Android phones are incompatible. They have different software ecosystems, and even a different charger. Now think of this on a larger scale. Imagine devices that are designed to work in one region, but are incompatible with another region; your smart home devices from one continent don’t seamlessly integrate with a car system manufactured on another continent because of different microchip standards or software environments.

This reduced compatibility can affect certain apps, services, or repair parts that could work in one region but not in another. It will complicate travel and cross-border innovation.

The techno-nationalism trend in governments may lead to more fragmented data-flows because of privacy concerns. They may impose strict regulations on data transfer, cloud services, and the availability of certain applications, as we have seen with Tik Tok.

Economic Effects

Microchips can also affect the production price of anything made in a factory, because the heavy machinery used also relies on microchips, inflating prices across the board. Even if the end product you’re buying is technically not an electric device, if it was made with one, you could still be affected.

Onshoring fabrication plants in Europe, the U.S., Japan, etc… will change the future landscape of microchip-related jobs. Skilled workers in the industry may find themselves without a job, or they may need to move countries.

The current trend of reshoring and friend-shoring supply chains will require high upfront investment costs. However, it should create a more reliable production pipeline, reducing risks of a crisis in the long term. Countries will likely prioritize stability over pure capitalistic cost efficiency.

Another way to increase supply chain resilience is to have multiple potential sources for the same chip, especially for critical components. If one goes down, you can still rely on the other.

The crisis may push technological innovation in new directions, such as devices that use fewer chips or more readily-available ones, or even the development of entirely new optical chips like in China, and it encourages smart innovations like Advanced packaging technologies. For example “chiplets” that allow different components of a chip (e.g. the CPU, GPU, and memory) to be manufactured separately, and then combined seamlessly into one package. This offers more flexibility in finding suppliers and reduces reliance on a single manufacturer.

In the long run, complete technology sovereignty may prove to be too impractical, and countries will still have to cooperate, or at least to find more permanent allies in the chip wars. For example, there are discussions between Japan, the U.S., South Korea, and Taiwan of creating an alliance called the “Chip 4” or the “Quad”.

Consumers may also prioritize longevity and right-to-repair over buying new disposable products.