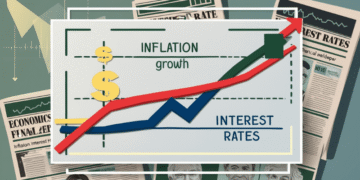

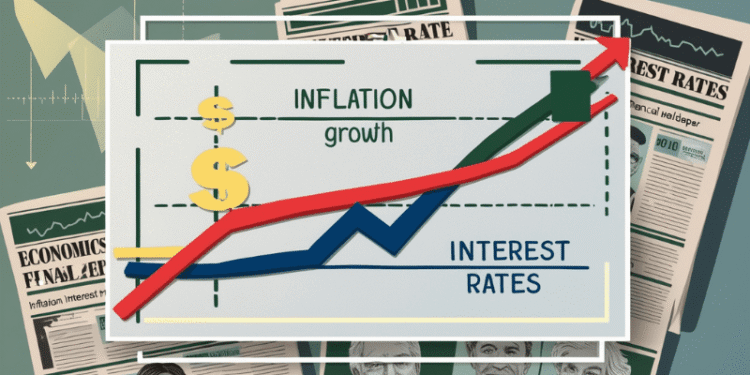

Inflation and interest rates are two of the most prominent economic indicators that directly impact the lives of individuals, businesses, and countries alike. They form the cornerstone of understanding monetary policy and how it impacts economic activity. The relationship between these two concepts is not merely linear; it is interactive and complex, and is a focus of attention for central banks and economic decision-makers around the world.

The close relationship between inflation and interest rates is evident in how central banks use interest rates as a primary tool to combat inflation. In the face of high inflation, central banks often resort to raising interest rates in an attempt to reduce aggregate demand and cool the economy, thereby curbing rising prices. Conversely, in periods of recession or low inflation, interest rates may be lowered to encourage borrowing and spending and stimulate economic growth.

Understanding this dynamic relationship is crucial for policymakers, investors, and consumers, as decisions regarding interest rates are made based on expectations of the path of inflation and have profound implications for economic and financial stability.

What is inflation?

Inflation refers to the general and sustained rise in the level of prices for goods and services over a specific period of time, eroding the purchasing power of money. Inflation has many causes. It may result from an increase in aggregate demand that exceeds available supply (demand-pull inflation), or from a rise in production costs (cost-push inflation). While inflation can be moderate and even stimulate economic growth at times, it can become a dangerous and destructive phenomenon when it gets out of control, causing a decline in living standards and economic instability.

Interest Rate

The interest rate is the cost borrowers pay for money, or the return depositors receive for depositing their money. The interest rate is a key tool used by central banks to control the money supply in an economy. When interest rates rise, borrowing becomes more expensive, which reduces spending and investment, and vice versa.

How do inflation and interest rates affect global and local markets?

Inflation and interest rates are among the most important economic indicators that interact in a complex way and impact all aspects of the economy, from the global macroeconomics to the daily lives of individuals and businesses.

Global Effects of Inflation

· Disruption of supply chains: Global inflation can disrupt supply chains, particularly for essential goods such as food and energy, increasing production and transportation costs around the world

· Decreasing purchasing power of currencies: High inflation in any country erodes the purchasing power of its currency, affecting its competitiveness in international trade.

· Impact on consumption and investment: High inflation rates negatively impact consumption, investment, and exports at the aggregate level, reducing global economic activity.

· Economic instability: High and persistent inflation can lead to global economic instability, threatening growth and affecting investor confidence.

· Growth inequality: While some major economies may remain resilient in the face of inflation, low-income and developing economies may experience significant declines in growth prospects due to conflict and rising costs.

Global Interest Rates

· Impact on Capital Flows: Interest rates in major economies, such as the United States and the Eurozone, affect global capital flows. Higher interest rates in these economies may attract capital, affecting the stability of developing countries’ currencies.

· Increasing the Cost of Global Borrowing: When global interest rates rise, borrowing costs for governments and companies worldwide increase, increasing debt burdens and limiting investment capacity.

· Pressure on Banks: Prolonged high interest rates can expose weaknesses in some global banks, particularly those that invest in bonds whose value declines as interest rates rise, potentially leading to financial crises.

· Impact on Foreign Exchange Markets: Higher interest rates increase the cost of borrowing the national currency, making lending more profitable and loans more expensive. As a result, the value of the national currency increases in foreign exchange markets. The opposite is true when interest rates fall.

Inflation and Interest Rates: Wide-Ranging Effects on Your Life and Investments

Both inflation and interest rate changes have profound and far-reaching effects on our daily lives and investment decisions. These important effects can be understood as follows:

The Impact of Inflation on Citizens

· Erosion of Purchasing Power: This is the most obvious effect. As prices rise, the value of money declines, meaning that citizens will have to buy fewer goods and services with the same amount of money.

· Depreciation of Savings: The value of cash savings erodes with rising inflation, limiting individuals’ ability to achieve their future financial goals.

· Rising Cost of Living: Inflation increases the costs of food, housing, transportation, healthcare, and education, straining household budgets and lowering their standard of living.

· Redistribution of Income and Wealth: Inflation often leads to an unfair redistribution of income and wealth, with fixed-income earners, such as employees and retirees, being disproportionately affected, while others, such as asset owners, may benefit.

· Loss of confidence in the national currency: In cases of very high inflation, citizens lose confidence in their national currency and may turn to foreign currencies or other assets such as gold and real estate to preserve the value of their money.

Impact of interest rates on citizens

· Borrowing costs: Higher interest rates increase the cost of borrowing from banks, whether for personal loans, car loans, or mortgages, making it more difficult and expensive to obtain financing.

· Savings returns: On the other hand, depositors benefit from higher interest rates, as they receive higher returns on their deposits and investment certificates at banks, which encourages savings.

· Impact on the real estate market: Higher interest rates negatively impact the real estate market, as mortgage loans become more expensive, reducing demand for purchases and affecting real estate prices.

· Impact on consumer spending: Higher interest rates reduce the income available for consumer spending, as a larger portion of income is directed toward debt repayment, slowing down the pace of spending.

The Impact of Inflation on Businesses

· Rising Production Costs: Businesses face rising costs for raw materials, energy, wages, and transportation due to inflation, which reduces profit margins.

· Difficulty in Planning: High inflation makes it difficult for businesses to plan for the future, as costs and revenues become uncertain.

· Sales Impact: Businesses may be forced to raise product prices to cover increased costs, which can lead to reduced consumer demand and lower sales.

· Asset Valuation Challenges: Businesses that hold their assets and liabilities in foreign currencies face financial reporting challenges due to exchange rate fluctuations linked to inflation.

· Investment Impact: Inflation negatively impacts investment levels, reducing businesses’ ability to save and invest in expansion and development.

Impact of Interest Rates on Businesses

· Borrowing Costs: Rising interest rates increase the cost of borrowing for businesses, increasing the cost of financing expansion or new investments and reducing the incentive to borrow.

· Earnings Impact: As borrowing costs rise, businesses’ profits decline, especially those that rely heavily on debt to finance their operations.

· Impact on the Stock Market: There is often an inverse relationship between interest rates and stock market performance. When interest rates rise, stock prices may decline due to reduced investment and stagnant cash flow.

· Benefits from Positive Cash Flow: Companies with positive cash flow can benefit from higher interest rates by investing their cash flows in higher-yielding securities.

· Employment Slowdown: Higher interest rates may lead to a slowdown in hiring at companies, leading to higher operating costs.

Note:

Inflation and interest rates are two sides of the same coin in economics, and managing them requires a careful balance by central banks and governments to ensure stability and sustainable economic growth at both the local and global levels.

Also read:

l should-you-buy-bitcoin-now-or-is-it-too-late-in-2025

l a-leak-reveals-the-iphone-17s-battery-capacity-predicting-radical-changes

l samsung-unveils-its-thinnest-phone-the-galaxy-z-fold-7

l a-self-driving-tesla-taxi-crashes-into-a-parked-vehicle